Complytek's technology ensures that you stay compliant with regulations across different time zones, providing an ideal environment for player onboarding. Our platform offers:

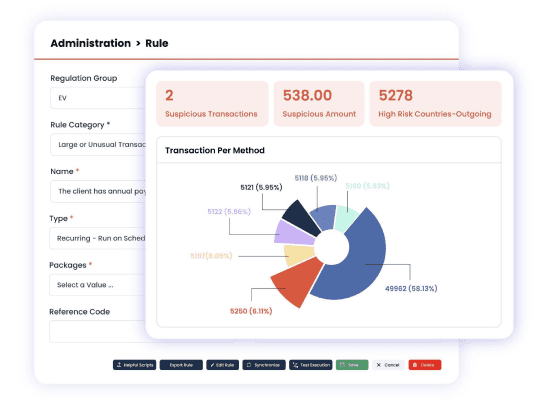

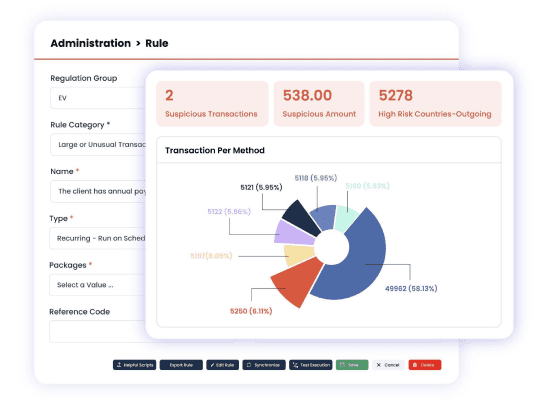

Complytek uses dynamic rule creation to monitor corporate data, detect gaming and gambling patterns, identify suspicious activities, and halt high-risk transactions instantly. With our solutions, you can:

Complytek provides superior gaming and gambling compliance solutions for KYC and AML, facilitating real-time onboarding, monitoring, and automated transaction checks.