Simplify onboarding and automate complex processes with our robust workflow engine for an enhanced client and compliance team experience.

Discover More

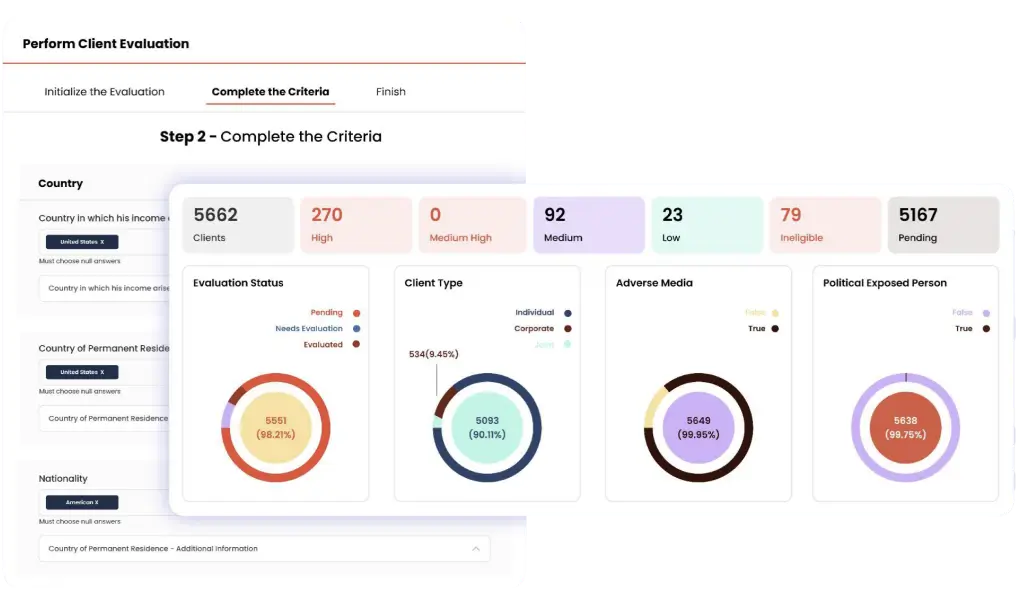

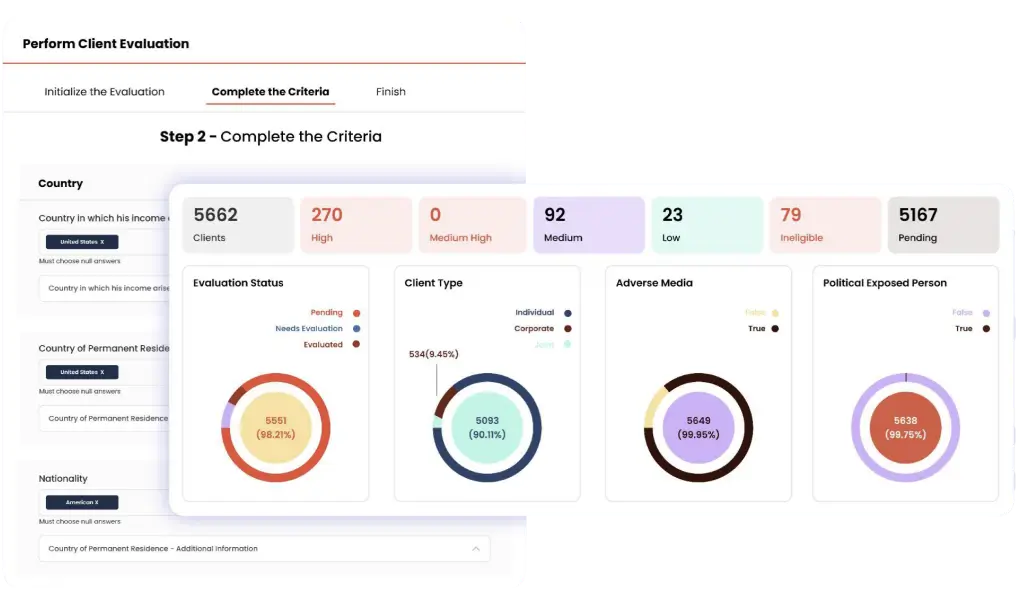

Efficiently assess risks related to money laundering and terrorism financing across multiple jurisdictions for robust regulatory compliance.

Discover More

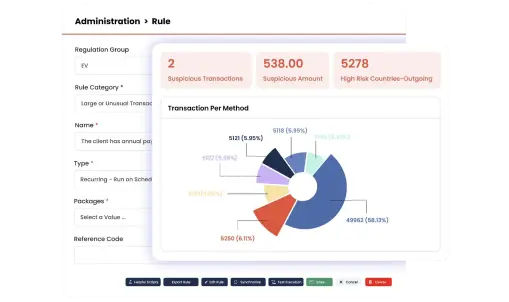

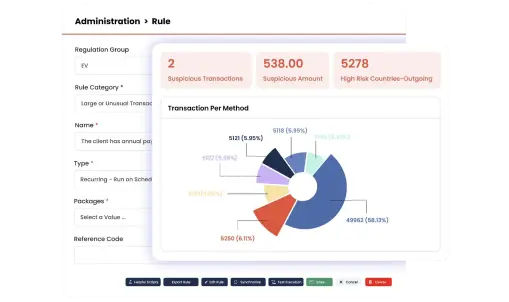

Leverage machine learning and rule engines to detect suspicious transactions and identify unusual customer behaviour patterns.

Discover More

Perform real-time screening of payment counterparties against watchlists, sanction lists, and predefined criteria to flag potential risks.

Discover More

Harness AI, machine learning, and advanced analytics to detect fraud patterns and anomalies during financial transactions and provide robust authentication.

Discover More

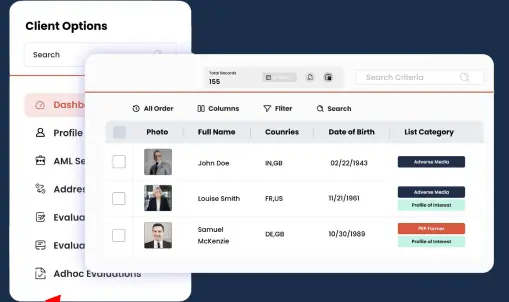

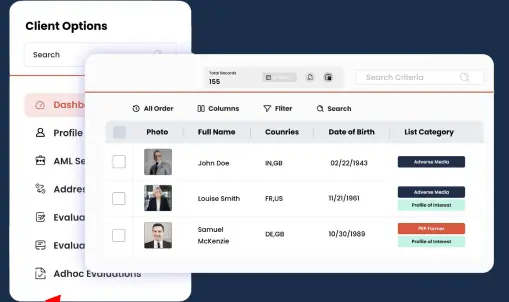

Ensure regulatory compliance and mitigate risks with our comprehensive tools for evaluating and verifying the identity and background of potential customers.

Discover More

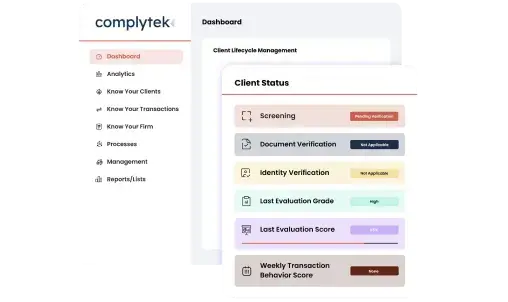

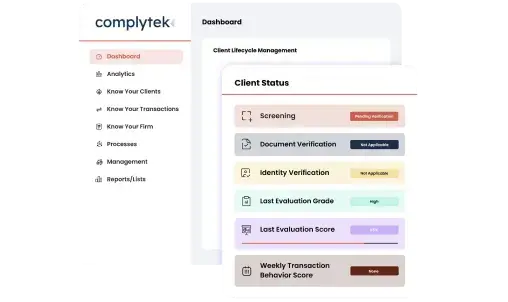

Empower your business with our unified KYC & AML solution that blends a regulatory rules engine, machine learning models, and global KYC compliance with hundreds of data sources.

Compliance

Simplified

Ease your operational hurdles with our seamless onboarding and ongoing monitoring solution. Enjoy easy parameterization tailored to your firm's individual risk profile for a truly personalized approach.

Onboard

with Ease

Stay ahead of the curve with our AI-Powered platform, ensuring regulatory compliance with the latest regulations. Our proactive approach to risk management protects you from reputational harm.

Stay Ahead,

Stay Compliant

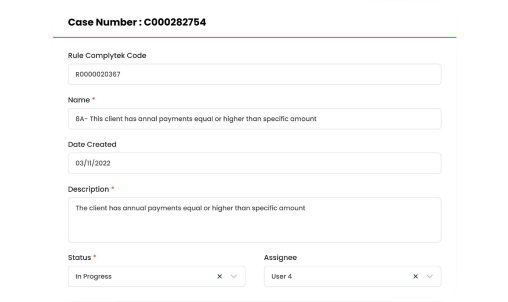

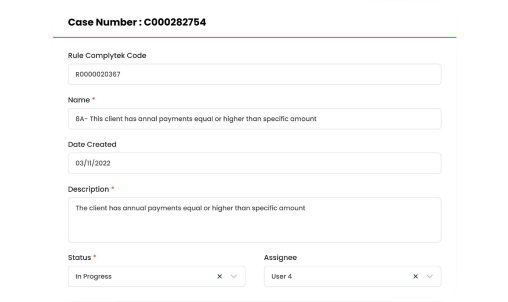

Our centralized compliance and case repository, coupled with leading API integration for seamless automation, offers efficiency and cost savings by automating processes. It's a scalable solution to handle diverse regulatory frameworks.

Effortless

Efficiency

“Thank you Complytek for helping us streamline all our compliance operations. The installation of your advanced risk scoring and assessment tool has vastly eased our workload, and we are especially pleased with the customizable risk factors that help us work across multiple jurisdictions.”

“When it comes to choosing automation to aid your compliance department with AML and KYC objectives, an organisation should evaluate knowledge, expertise and level of support. Complytek and its team of professionals rank high in all these parameters.”

"Your innovative product has changed the way we work. With near real-time onboarding and a host of automated processes, the software solution has freed up our precious time, as well as allowing us to offer our clientele a much smoother experience.”

"We consider Complytek as an integral part of our team. Being able to work directly in the tool rather than making changes offline was something that we really needed. The second feature that resonated with us was the workflow stream in the whole audit process. Having our audits in a central location has resolved much of the email traffic and eliminated workflow bottlenecks that pop up when for example colleagues go on vacation and we can’t access their work. But most important of all, was that it successfully incorporated and automated our audit execution and follow up methodologies."

"We have not just acquired a well rounded GRC solution which helped us automate, centralize and simplify our Risk Management processes. Bank of Cyprus has gained a long lasting partner and this is due to Complytek’s professionalism, high quality customer support and great calibre solutions that they offer."

“Complytek’s KYC, AML, FRAUD Solution is real value for money. You won’t find a more cost-efficient product to keep in line with all the regulations. The team is always there to provide great support!”