At Complytek, we specialize in developing software solutions that help banks and financial institutions navigate intricate regulatory landscapes. Our technology simplifies compliance, mitigates risk, and identifies financial crimes, allowing your team to focus on what really matters.

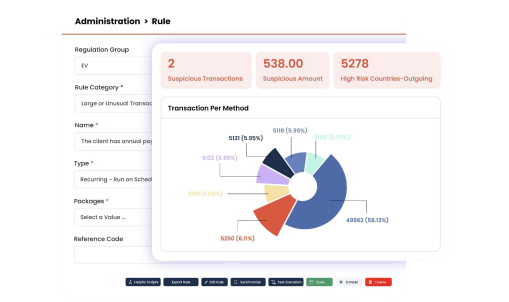

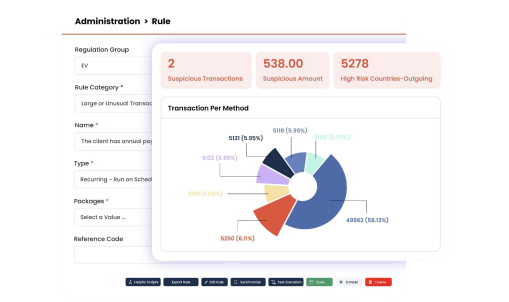

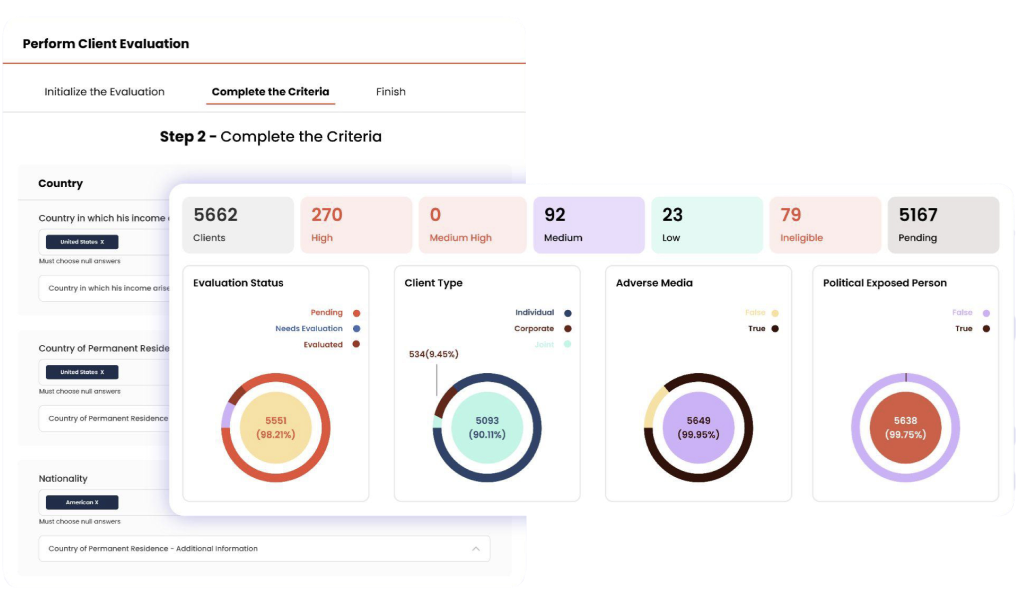

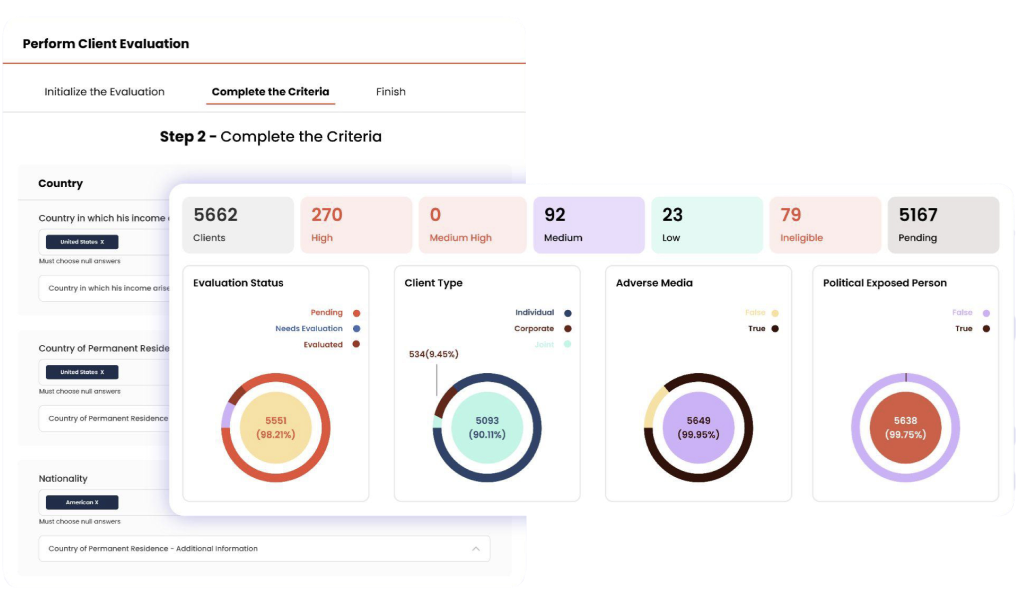

Complytek’s state-of-the-art KYC, AML and Fraud Solutions empower banks and financial institutions to detect, monitor, and report suspicious transactions swiftly and efficiently. Utilize our tools to improve your financial crime defenses and ensure absolute compliance with stringent regulations.

In today's volatile financial landscape, staying one step ahead is crucial. Complytek's risk management software solutions provide real-time monitoring and analysis, keeping your institution safe and your operations smooth. Turn risk into advantage with our robust, reliable, and revolutionary solutions.

In an era of increasingly stringent regulations and heightened financial risk, Complytek stands as your trusted partner. We understand the complex challenges that banks and financial institutions face daily and offer advanced software solutions designed to streamline processes, mitigate risks, and ensure total compliance.

Experience the Complytek AdvantageFrom Onboarding, AML and KYC, to Risk and Compliance Management, our Solutions are your all-in-one partners for a 360-degree perspective of your business. Why wait? Make the smart move and get started with Complytek’s technology today.

Risk Management: Enables banks to identify, assess, and mitigate risks efficiently. Features like real-time monitoring, automated risk assessments, and predictive analytics help institutions preempt and address potential threats.

Internal Audit: This module facilitates systematic audits of all bank operations, ensuring that they adhere to established internal processes and external regulatory standards. It promotes transparency, accountability, and efficiency.

Compliance Management: Streamlines the process of ensuring complete adherence to all relevant regulatory standards. It includes tools for tracking regulatory changes, automating compliance workflows, and generating necessary reports for oversight bodies.

Incident & Loss: This module focuses on detecting, documenting, and responding to incidents that could result in financial loss. It helps banks to quickly address these issues, minimize potential damage, and implement preventive measures for the future.