In an era where the digital landscape is ever-evolving, the ACAMS Cyprus Chapter webinar, titled “What is MiCA and Why Should I Care?” offered insights into the Markets in Cryptoassets (MiCA) Regulation. Held on March 13, 2024, this webinar revealed the path for understanding MiCA’s forthcoming impact on the crypto compliance landscape. We, at Complytek, are thrilled to recount the participation of our esteemed CEO, Faisal Islam, as a key speaker in this enlightening session.

The webinar aimed to explain MiCA, a regulation set to reshape the contours of crypto compliance by December 2024. Garnering significant interest, with more than 300 registrations, the event saw an impressive engagement from the community, reflecting the growing urgency among professionals to align with MiCA’s guidelines and timelines.

Moderated by Gregory Dellas, the Cyprus Chapter Chair and Chief Compliance & Innovation Officer at ECOMMBX, the webinar featured a stellar lineup of speakers. Each brought a wealth of knowledge and perspective to the table. This icludes George Theocharides, PhD, Chairman of the Cyprus Securities and Exchange Commission (CySEC), and Nico Di Gabriele, Senior Lead Supervisor at the European Central Bank.

Mr. Theocharides delved into the essence of MiCA, elucidating its scope and rollout timelines. He also covered its anticipated impact on crypto exchanges and the public at large. Moreover, he offered actionable insights on achieving compliance in a timely manner, emphasizing the importance of staying informed and prepared as MiCA gears up to redefine the crypto compliance landscape.

Mr. Gabriele, offering his perspective, emphasized the collaborative effort required to navigate MiCA’s complexities. As he remarked, MiCA represents a significant step forward in our journey towards a more secure and transparent digital finance ecosystem, underscoring the regulation’s broader benefits.

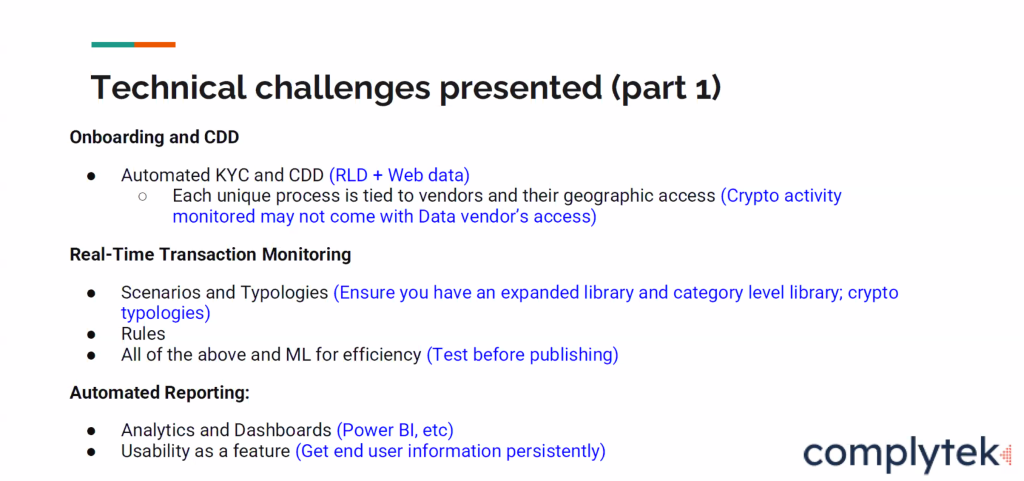

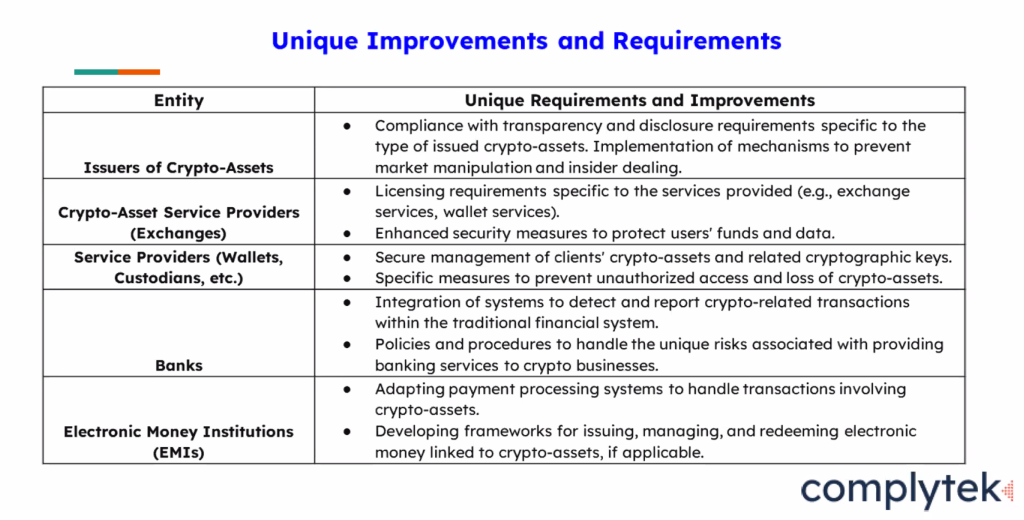

During the webinar, Faisal Islam offered an in-depth analysis of the practical challenges and considerations for market participants in light of MiCA, with a special focus on Anti-Money Laundering (AML) and the automation of the Know Your Customer (KYC) and Customer Due Diligence (CDD) processes. His presentation delved into the technical nuances of integrating web data across its various evolutions—from web 1.0 to web 3.0—into the KYC and CDD processes. This integration, he argued, is pivotal for enriching digital identities and enhancing the compliance framework.

The Importance of Web Data in Compliance

Faisal emphasized the overlooked potential of web data in shaping a more robust AML framework. “One of the main failures across the KYC implementations is the exclusion of web 1.0, 2.0, 3.0 data—monikers, handles, a mass of details, usernames. Including such data not only provides a large amount of context behind digital identities but also significantly bolsters the KYC and CDD process“, Faisal explained. This approach, he highlighted, is critical for adapting to and overcoming the complexities introduced by the digital age in financial transactions and compliance efforts.

Furthermore, Faisal shed light on the intricacies of risk assessment in a crypto-inclusive financial environment, advocating for a dynamic and perpetual approach to risk profiling. This approach, he suggested, must account for the unique and evolving nature of cryptocurrency transactions and their impact on the risk landscape.

For those who missed the live session or wish to revisit the discussions, we will be including some screenshots from our CEO’s presentation in this blog post.

In conclusion, the ACAMS Cyprus Chapter webinar on MiCA was a huge success, shedding light on critical aspects of crypto compliance and regulation. Last but not least, we thank all participants, speakers, and organizers for their invaluable contributions. Of course, the landscape of digital finance continues to evolve. Therefore, staying informed and prepared for regulations like MiCA is crucial for securing a compliant and prosperous future in the crypto ecosystem.

Stay tuned to our website’s company resources section for more insights and updates on similar events.